Start with a deep dive into your goals, priorities, and everything that shapes your financial life — so you can build a plan that actually works for you, not just on paper, but in real life.

THE

Financial Wellbeing Toolkit

All the tools you need to manage your money like the top 1%

![]() ‘I finally understand how all the pieces of my money fit together’ – Alice M, UK

‘I finally understand how all the pieces of my money fit together’ – Alice M, UK

Overwhelmed.

Unclear.

Unprepared.

The words you might use to describe your money situation right now.

You’ve been meaning to get it all together but every time you try, you hit a wall of jargon, generic advice, or thousand-dollar financial advisors.

You’re not looking for one-size-fits-all advice or cookie-cutter solutions. You want a plan that’s as tailored, dynamic, and ambitious as you are.

Most people work hard for their money -

But they’re flying blind when it comes to managing it.

Externally

You’re juggling bills, debt, and goals without a clear system.

Internally

It’s overwhelming, and makes you feel like you’re always behind.

Philosophically

The wealthy shouldn’t be the only ones with access to real tools.

Financial peace shouldn’t be a luxury - it should be standard.

YOUR COMPLETE FINANCIAL WELLBEING TOOLKIT

Simplified and Ready to Use.

Whether you’re just beginning your journey to financial wellbeing or enhancing an existing system, this toolkit is your all-in-one resource for building lasting financial health.

That’s why we created the

Financial Wellbeing Toolkit.

Built on the Strategies of the 1% – Designed for You

Most people never see the frameworks the wealthy use to grow and manage their money.

The Financial Wellbeing Toolkit changes that – giving you access to the same proven tools, simplified and adapted for your life, your goals, and your financial journey.

“ This was exactly what I needed. I finally understand how all the pieces of my money fit together – and it’s the first time I’ve felt genuinely confident about my future.

Financial Wellbeing Toolkit Customer

Alice M, UK

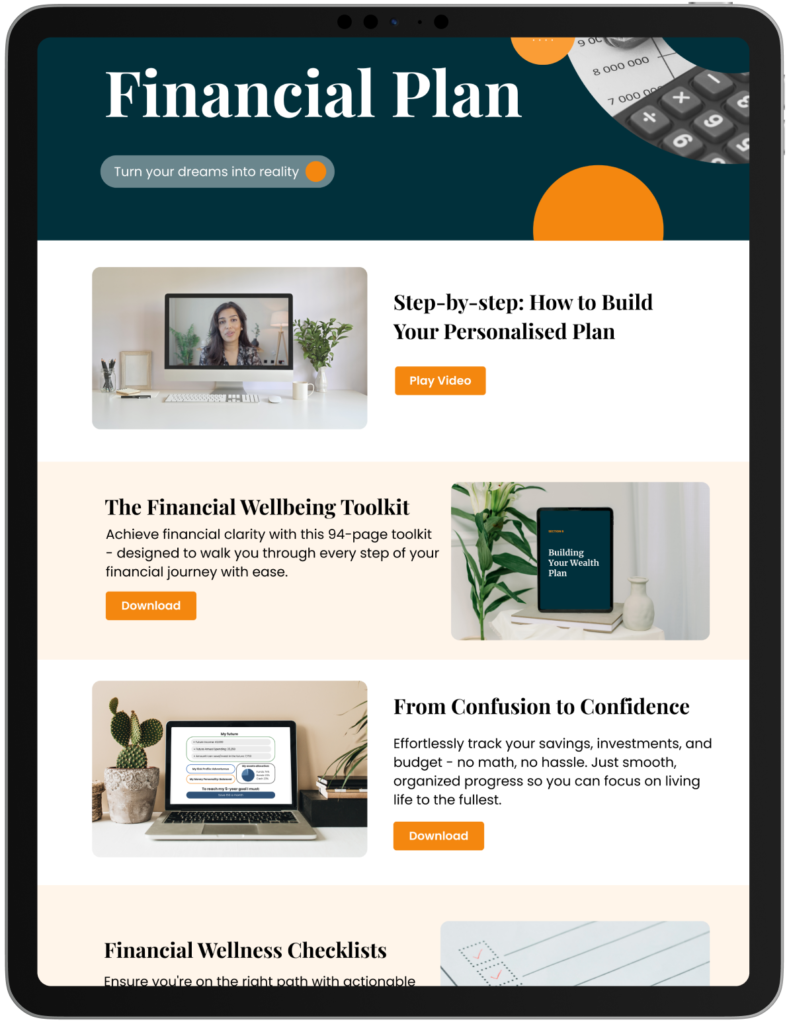

The Financial Wellbeing Blueprint

Tired of feeling overwhelmed every time you think about money?

This 94-page guide is your step-by-step system to go from “Where do I even start?” to “I’ve got this.”

- Practical tips, actionable steps, and simple exercises to help you take control

- Clear guidance on setting goals, organizing your investments, and tracking real progress

- Designed so you can stop second-guessing — and start building your plan with confidence and ease

No more information overload. Just a clear path forward.

The 1% Dashboard

Why wrestle with complicated setups when you can have it done for you? These ready-to-go spreadsheets handle the heavy lifting:

- Track everything you own – and everything you’re building

- Map out your savings and investment goals with crystal clarity

- Spot gaps, fine-tune your plan, and stay motivated as you grow

Just plug in your numbers and watch your personalized financial roadmap take shape. (It’s oddly satisfying.)

Investing Starter Pack

Think investing is confusing? You’re not alone — and you don’t have to stay stuck.

Inside, you’ll find:

- The essential tools you need to start (and actually feel good about it)

- Practical, jargon-free strategies for growing your money

- Step-by-step support whether you’re just starting or leveling up

Because when you understand investing, you don’t just grow your money — you take charge of your future.

Built-In Glossary for Financial Jargon

Sick of Googling every other word?

Every tricky term inside the Toolkit comes with a plain-English translation, so you’ll finally feel like you belong in the world of finance — no dictionary needed.

Inside The Financial Wellbeing Toolkit, You’ll Get:

“ I used to feel completely lost trying to manage my money. This guide gave me a roadmap. Now I know exactly what to focus on, and have a plan that I can finally trust.

Financial Planning Guide Customer

Paul W, US

Here’s How It Works

01

Download the Toolkit

02

Work Through Each Section at Your Own Pace

Follow the simple prompts, tools, checklists, and quizzes at your own pace.

Each step is designed to unlock your financial potential and move you closer to every goal – faster and with more confidence.

03

Walk Away With a Personalised Financial Plan

By the end, you’ll have a complete, expert-crafted plan – tailored to your life – ready to put into action and turn your biggest dreams into reality.

The Alternative?

Keep guessing your way through your finances and hoping it’ll all just “work out.”

Keep screenshotting random TikToks or piecing together advice from Reddit and YouTube, wondering if it applies to you.

Stay stuck in that place where you kinda-sorta know what to do… but not really.

With The Financial

Wellbeing Toolkit…

You Will...

- Build your very own complete financial plan – guided by expert strategy, but tailored to your numbers

- Understand what’s holding you back financially, and how to fix it

- Feel in control of your money and confident about your next steps

- Know how to create and reach your goals, invest smarter, and review it all over time

Without It, You Risk:

- Wasting hours (and years) stuck in confusion and overwhelm

- Missing opportunities to grow your wealth and secure your future

- Making decisions based on guesswork instead of strategy

- Staying stuck in financial stress, instead of building freedom and peace of mind

Imagine a few short

weeks from now…

YOU’RE SITTING DOWN WITH A CUP OF TEA AND OPENING

YOUR FULLY FILLED-OUT FINANCIAL PLAN — AND FOR THE FIRST TIME EVER…

YOUR FULLY FILLED-OUT FINANCIAL PLAN — AND FOR THE FIRST TIME EVER…

You feel total clarity.

- You know exactly where your money is, where it’s going, and how it’s growing.

- You set financial goals without second-guessing - and you’re already seeing real progress.

- You’ve built a personalized roadmap that fits your life, not someone else’s.

- You feel empowered, confident, and in control - no more confusion, no more overwhelm.

And best of all - you’re no longer just hoping things will work out.

You know they will - because you have a plan.

All you have to do is start

A glimpse of what’s inside:

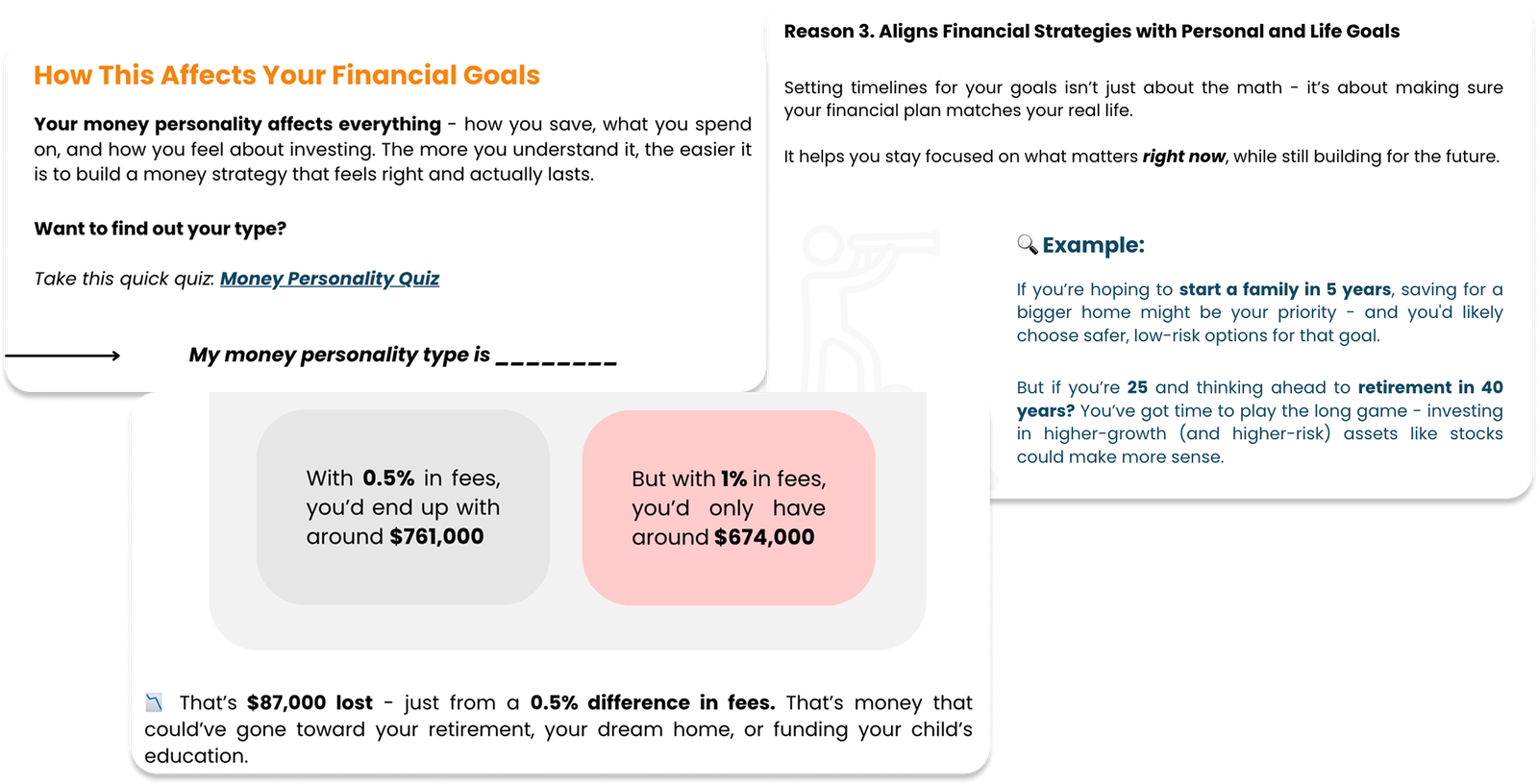

Goal Clarity

Prioritise your financial goals, create a system for making smart trade-offs, and set timelines that are actually realistic.

Investing Confidence

Learn where to invest, which platforms to use, and how to build an asset allocation strategy that matches your goals and risk tolerance.

Spending Mastery

Review your income and spending patterns, develop a 12-month spending plan, and map out major expenses without stress.

Savings Growth

Establish strong emergency savings, and calculate exactly how much you need to save for retirement or financial independence.

Effortless Budgeting

Build a budgeting system that feels natural and sustainable – breaking down complex money management into simple, empowering steps.

Debt Freedom

Create a clear, confident plan to tackle debt, understand all your options, and move toward financial freedom without overwhelm.

The Financial Wellbeing Toolkit is packed with even more tools, strategies, and insights — all designed to help you take control of your money and build the future you want.

You don’t need another

financial app.

You need a plan.

One that brings all the pieces of your finances together in a way that makes sense.

This is that plan.

Let’s get started.

Still have more

questions?

I've tried other financial tools before. How is this different?

Unlike generic budgeting apps or one-size-fits-all advice, this system is built to align with your personal goals, lifestyle, and aspirations. It’s about building a cohesive financial strategy that’s tailored to you.

How much time will I need to invest to see results?

This is designed to work around your lifestyle. By dedicating just a few focused hours upfront, you’ll create a system that works seamlessly in the background—saving you time and mental energy in the long run.

Can I use this planner if I'm not based in the UK or the US?

Absolutely. This system is designed to be flexible and adaptable, regardless of your location.

Can I get a refund after purchasing the Financial Wellbeing Toolkit?

Because this is a digital product with instant access to all materials, all sales are final and non-refundable.